How to Check Groww IPO Allotment Status on BSE

Checking your IPO allotment can be one of the most exciting steps for new and experienced investors. After applying for shares through Groww, everyone wants to know whether they’ve received the allocation or not. The good news is that understanding your Groww IPO allotment status is quite simple once you know the right process.

This detailed guide will walk you through how to check your Groww IPO allotment on BSE, explain the Groww IPO application process, discuss Groww IPO listing details, and share useful tips to make sure you never miss an update. Whether you’re a beginner or an active market participant, this blog step-by-step explanation that will help you quickly verify your IPO results and understand every part of the allotment process.

Understanding the IPO Allotment Process

When a company launches its Initial Public Offering (IPO), investors can apply through trading platforms like Groww. After the subscription period ends, shares are allotted to successful applicants. The Groww IPO allotment process is managed by the company’s registrar and the BSE portal, which displays the final results once allocations are confirmed.

The Groww share allotment process ensures fairness. Each investor has an equal chance based on demand and availability. The number of bids determines whether an IPO is oversubscribed or undersubscribed. Oversubscription often reduces the individual chance of allotment since more people apply for fewer available shares.

If you’ve applied through Groww, your Groww IPO application details will be automatically forwarded to the exchange and registrar for processing. Once finalized, you can easily check your IPO allotment using your application number, PAN, or DP ID through the Groww IPO portal.

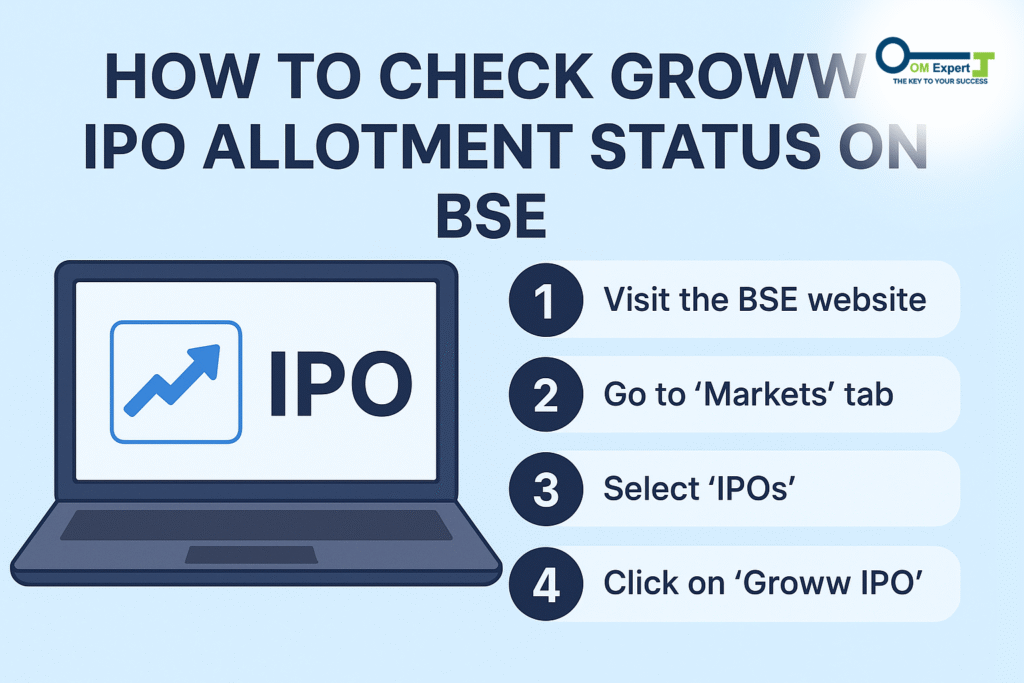

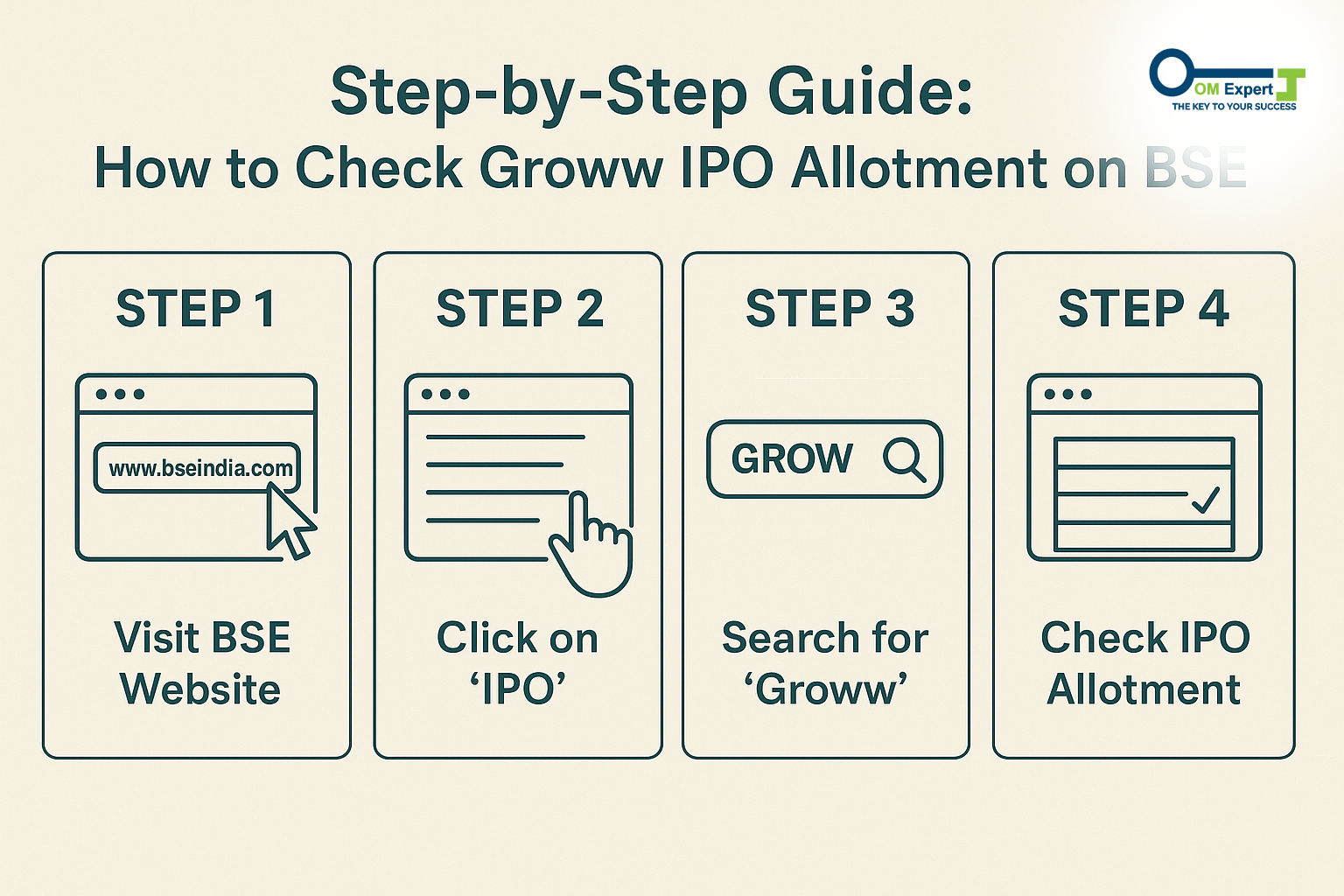

Step-by-Step Guide: How to Check Groww IPO Allotment on BSE

The most reliable and official way to check your IPO allotment is through the BSE website. Here’s a simple, step-by-step method anyone can follow:

Step 1: Visit the Official BSE IPO Portal

Go to the official BSE Groww IPO portal. This page is specifically designed for IPO investors who wish to verify their allotment results online.

Step 2: Select “Equity” Under Issue Type

Choose “Equity” from the dropdown menu. This tells the portal you’re checking for equity shares rather than bonds or other securities.

Step 3: Choose the IPO Name

From the list of available IPOs, find and select the name of the company whose shares you applied for. In this case, select the Groww IPO allotment entry.

Step 4: Enter Your Application Number or PAN

Next, enter your IPO application number or your PAN. Make sure all digits and letters are correct to avoid errors.

Step 5: Verify and Submit

Fill in the captcha or verification code shown on the screen. Then, click on the “Submit” button.

Step 6: View Your IPO Allotment Result

After submission, your IPO allotment status will appear on the screen. It will clearly show whether you have received the shares.

If allotted, you’ll also see details such as the number of shares allocated and the Groww IPO shares price. If not, don’t worry, you’ll soon receive your Groww IPO refund automatically.

Common Reasons for Delay in IPO Allotment Updates

Sometimes investors face a delay in viewing their IPO allotment result. Here are some common reasons for such delays:

- High Subscription Levels: If the Groww IPO subscription numbers are very high, the registrar takes more time to finalize allocations.

- Technical Delays: Heavy user traffic or system updates can delay results on the BSE IPO check page.

- Incomplete Details: Incorrect PAN, DP ID, or application number may result in an error while checking your Groww IPO status.

- Bank Confirmation Pending: If your Groww IPO payment status isn’t confirmed, your application might not be processed in time.

Patience is key. The registrar and BSE usually update allotment details soon after verification. Always ensure you have a stable internet connection and accurate details before you check IPO allotment status again.

Groww IPO Allotment Details and Refund Process

If you’re allotted shares, congratulations! The shares will reflect in your demat account within a few days. However, if you didn’t get an allotment, your money will be refunded. The Groww IPO refund process happens automatically through the same payment method used during the application. Your Groww IPO refund timeline usually depends on the registrar and your bank’s processing system. You’ll also receive an email or SMS confirmation about your refund once it’s initiated.

To verify whether the refund has been processed, you can check your IPO payment status or bank statement. The amount blocked during the IPO application (via UPI or ASBA) will be released if shares are not allotted. In addition, investors can check the Groww IPO result on the BSE IPO result page or through the Groww IPO allotment link BSE option, which provides real-time updates.

Important Terms Related to IPO Allotment

Here are some key terms every investor should know while checking IPO allotment on BSE:

- Groww IPO investors: Individuals who have applied for the shares through the Groww platform.

- Groww IPO registrar: The authorized agency responsible for allotment, refunds, and processing results.

- Groww IPO allotment date: The day when the allotment process is officially completed.

- IPO listing date: The day when allotted shares start trading on the stock exchange.

- Groww IPO verification: A step that ensures all application details match the records before allotment.

- Groww IPO final status: The confirmed result indicates whether shares have been allotted.

- IPO allotment site: The BSE page where you can check your final status online.

Understanding these terms helps you navigate the IPO allotment process smoothly without confusion.

IPO Listing and Share Price Insights

Once the Groww IPO allotment is done, investors eagerly await the listing. The IPO listing date marks the day shares begin trading on the stock exchange. This is when investors can sell their allotted shares or hold them for potential long-term gains.

The Groww IPO share price during listing can be higher or lower than the issue price depending on market sentiment, demand, and overall market performance. If the company performs well, early investors may see good listing gains.

For those who didn’t get shares, tracking the Groww IPO update on listing day can help in planning secondary market purchases. Always compare listing prices with market trends and make decisions carefully.

Why Checking IPO Allotment on BSE Is the Best Option

The IPO allotment status BSE page is considered the most authentic and timely platform to verify allotment results. It connects directly with the registrar’s database, ensuring accurate updates.

Here’s why using the BSE Groww IPO check online method is recommended:

- Official Source: Results are verified and displayed directly from exchange data.

- Simple Interface: Anyone can check allotment without technical knowledge.

- Instant Results: Quick status updates once the registrar publishes data.

- Accessible Anytime: The IPO allotment online feature is available 24/7.

Using BSE ensures that your IPO allotment result is authentic and free from errors.

Tips for First-Time IPO Investors

If you’re checking your Groww IPO allotment for the first time, keep these helpful tips in mind:

- Double-check details: Always confirm your Groww IPO application number or PAN before entering.

- Use correct spelling: Make sure the IPO name is selected accurately from the list.

- Avoid multiple refreshes: BSE may temporarily slow down due to high traffic; be patient.

- Check confirmation messages: Once allotment is complete, you’ll get your IPO confirmation through email or SMS.

- Track your refund: If you didn’t get shares, your IPO refund process will automatically begin.

Being careful and patient ensures you always get accurate Groww IPO allotment information.

Troubleshooting – When You Can’t See Your IPO Allotment

If your IPO allotment doesn’t appear right away, don’t panic. Here’s what you can do:

- Revisit the Groww IPO allotment link after some time; data may still be updating.

- Check if you entered your IPO application number correctly.

- Verify that your Groww IPO investor login details are accurate.

- Ensure your Groww IPO confirmation email has arrived; this usually means your details are in the system.

- If you still face issues, wait a few hours before trying again. Systems refresh regularly.

Remember, delays don’t mean rejection; they often occur because of verification queues during peak traffic times.

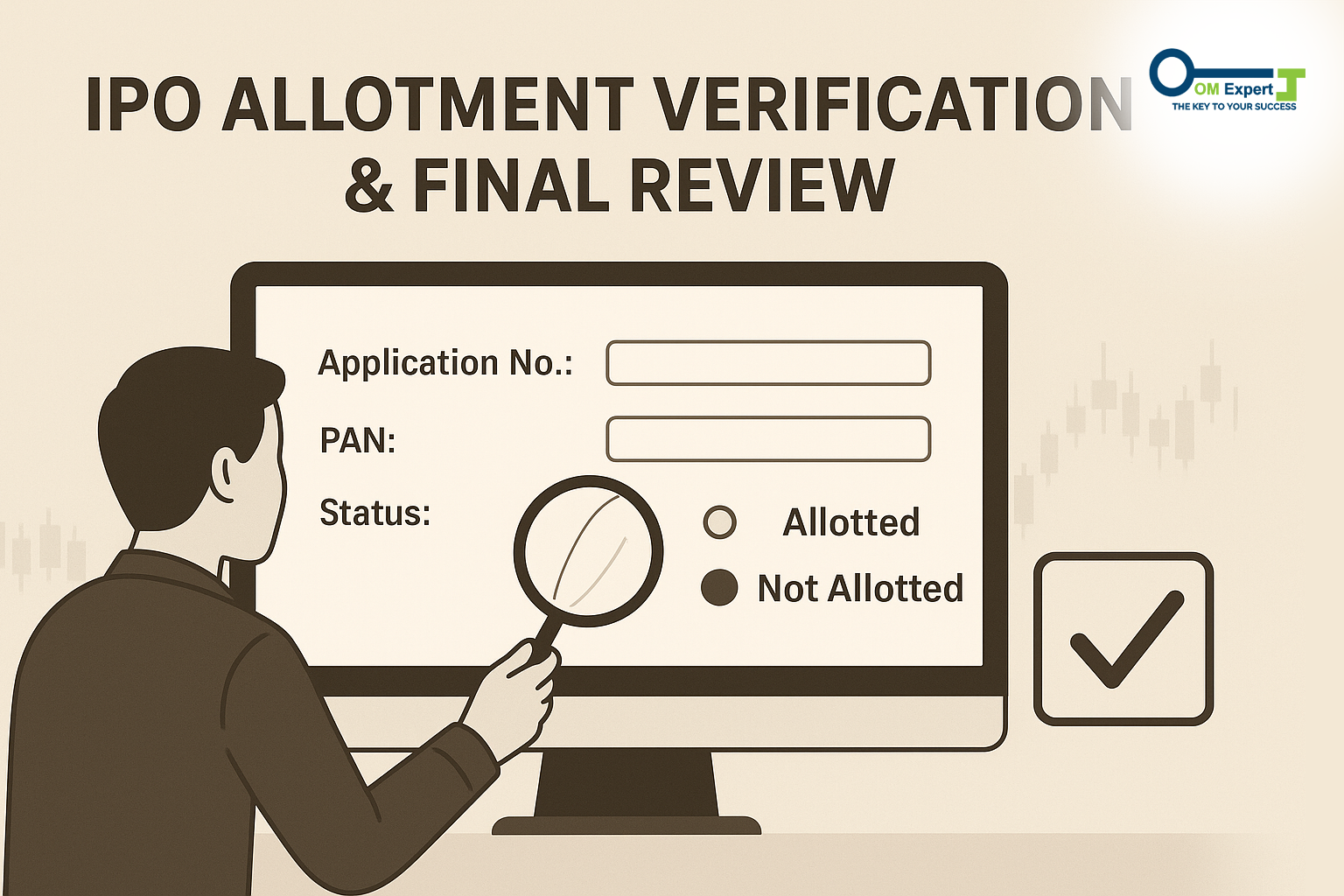

IPO Allotment Verification and Final Review

Once the allotment process ends, make sure you review your IPO allotment details carefully. Confirm that the number of shares allotted matches the number shown in your BSE result and Groww account. This verification step ensures your investment records are correct.

If you received shares, you can hold them until the Groww IPO listing date and decide whether to sell or hold based on the market trend. For those not allotted, you can explore the company’s performance after listing or apply for the next IPO.

Always read through your Groww IPO review before deciding on future applications. Understanding market performance and allotment ratios helps you make informed investment choices next time.

Conclusion

The IPO allotment process is straightforward when you know where to look and how to verify your details. Using the IPO allotment status BSE page is the safest and most reliable way to confirm your result. Whether you’re a first-time applicant or a regular investor, following this Groww IPO step-by-step guide ensures you never miss your Groww IPO result 2025 or refund updates.

Always stay patient and check carefully, allotment takes a bit of time but ensures fairness for every investor. Keep tracking updates, note your Groww IPO share allotment date, and review your results responsibly. For more simplified financial guides, step-by-step tutorials, and helpful investing tips, visit OM Expert, where we make finance easy to understand for everyone.